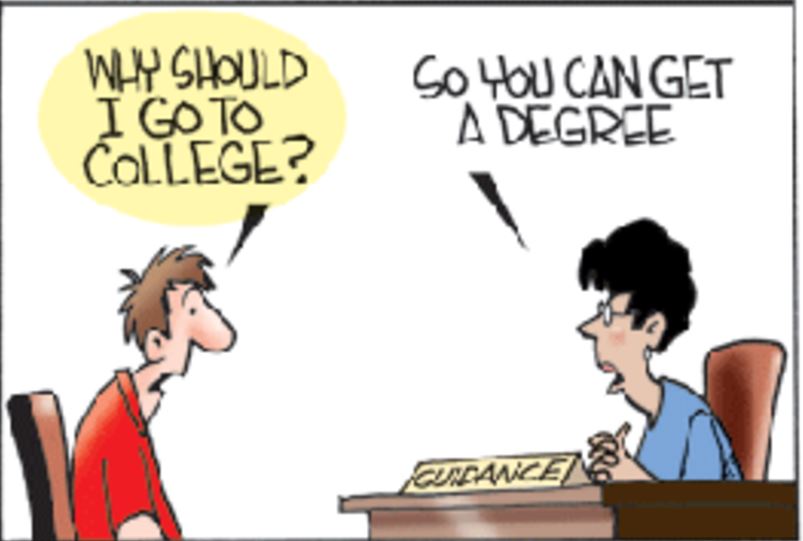

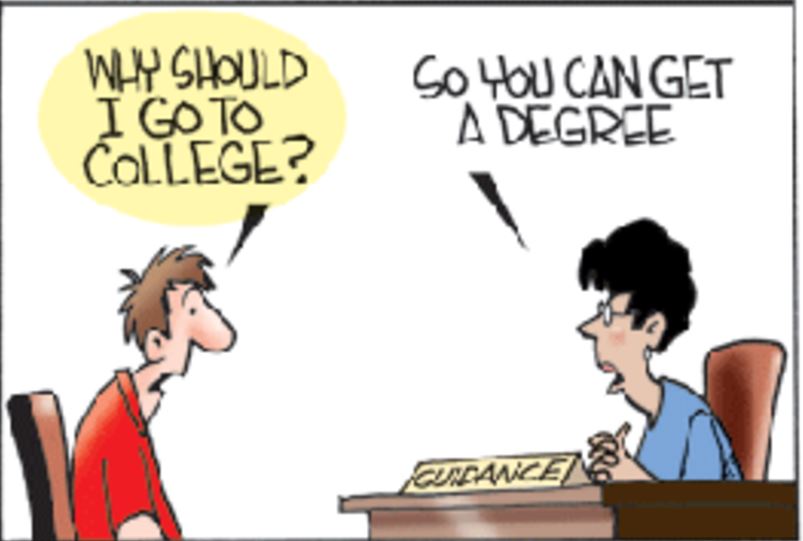

Nowadays some people question whether or not it is worth it to go to college. Let’s face it – college […]

Nowadays some people question whether or not it is worth it to go to college. Let’s face it – college […]

Gavin finished his first summer job recently. He earned a fair amount of money and asked me about the process […]

In America, we have a lot of choices when it comes to the things we buy. Think about it. When […]

This week I saw the band Blondie in concert at Wolf Trap. Beforehand I was not overly excited about the […]